‘Promulgation of the draconian and unconstitutional FICA Act was a coup d’état in South Africa by economic and financial mercenaries, without so much as firing a single bullet’ – Tshepo Kgadima

PROMULGATION of the draconian and unconstitutional Fica Act was a coup d’état in South Africa by economic and financial mercenaries, without so much as firing a single bullet – Tshepo Kgadima

THE ABSENCE of the rule of law and Constitution-based regulation of the banking industry in South Africa would cause immediate and irreparable damage to the economy, according to analyst and independent economist Tshepo Kgadima.

Kgadima, a former investment banker and an independent economic, energy and political analyst, has come out strongly against what he perceives as the banks’ crippling erosion of the country’s already fragile economy. He also raised concerns about the abusive and unlawful discriminatory practices of the top commercial banks.

Kgadima, an experienced company director of 20 years and a former chairperson of the Indian Ocean Rim Business Forum (2017-19), said the banks’ attitude in recent years was not helpful to bolstering the country’s economy, which was in a vulnerable state.

The country’s leading banks have been accused by several industry experts, political organisations, legal representatives, and consumers of closing bank accounts belonging to individuals and companies – without legal justification.

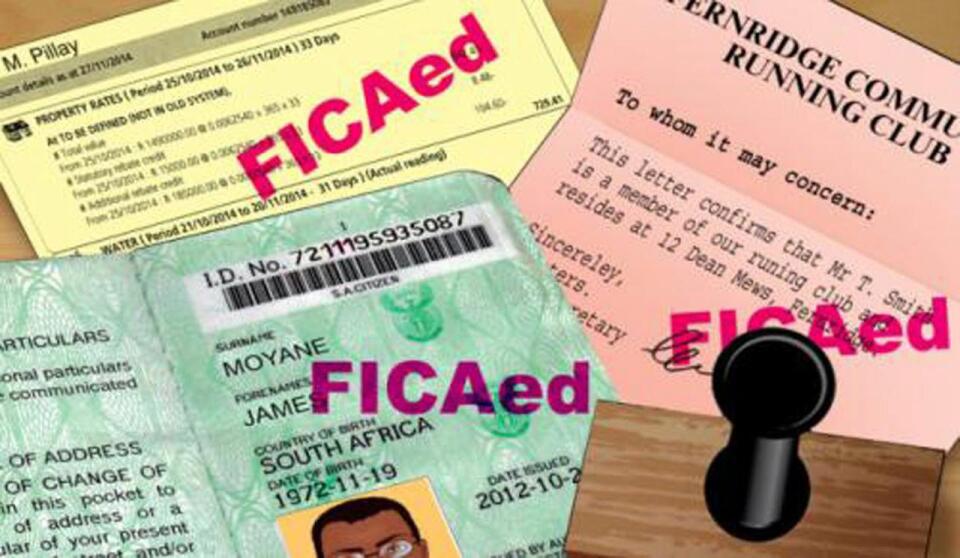

“Promulgation of the draconian and unconstitutional Financial Intelligence Centre Amendment (Fica) Act was a coup d’état in South Africa by economic and financial mercenaries without so much as firing a single bullet.

“Fica is the legalisation of state capture where state power has been seized at the centre by the banking ‘mafiocracy’. The entire leadership of the state is under the iron grip of imperialist forces who mete out draconian and unlawful punishment on citizens who are perceived enemies on flimsy grounds,” said Kgadima.

“Ordinary citizens and business leaders are now at the receiving end of an abuse of power by an oligopolistic banking cartel who just close bank accounts without any due process of law whatsoever. Sadly, the real ‘power on the throne’ is in the hands of totalitarian fanatics, delivered by a Gestapo-like squad of dominant banking firms.”

Kgadima was of the view that the country required urgent monetary policy and legislative reforms in the shape of amendments to the South African Reserve Bank (SARB) Act 90 of 1989; Banks Act 94 of 1990; Mutual Banks Act 124 of 1993; and the National Payment System Act 78 of 1998.

“The national assembly needs to have the gumption to effect legislation for nationalisation of the SARB which will cost no more than R55 million based on the current SARB share price of R17.50 per share.

“It is a sad state of affairs that the country is settled with an inept and indolent Parliament, which is in gross dereliction of Constitutional duty and has perpetually failed and inexplicably refrained from promulgating long overdue legislation, hence the undesirable state of arrested economic development we currently endure.”

Attempts to reach the national assembly were unsuccessful as the spokesperson in Parliament had not responded to questions by the time of publication of this article.

The systematic targeting and racial profiling of clients undertaken by South Africa’s banking sector continues to come under serious scrutiny as they are, to all intents and purposes, playing to a political gallery, in their purposeful termination of accounts held by numerous black-owned businesses.

As defence for their actions, the banks have relied on the judgment by the Supreme Court of Appeal (SCA) in the Bredenkamp & Others vs Standard Bank 2010 case, where the court held that banks had a right to terminate their relationship with clients.

South Africa’s commercial banks are citing the verdict in this case as a loophole to evade any accountability for their apparent random closure of company bank accounts across the land.

In the same judgment, the SCA, however, stated, “This power is exploited by banks to impose standard-form contracts on their customers,” and that such powers would be exercised oppressively, and there was undeniably an element of oppression when a bank decided to terminate the contract without good cause.

The most notable and current usage of this blanket fall-back is in relation to the termination of banking facilities for Sekunjalo Investment Holdings (SIH), its Chairman Iqbal Survé and other associated entities, which have become collectively known as the Sekunjalo Group (Sekunjalo).

The Bredenkamp case has set a dangerous precedent and one that Sekunjalo is challenging at varying levels of South Africa’s legal system, including the Equality Court and the Competition Commission.

Without proof of wrongdoing, the banks have opted to settle for the “reputational risk” clause as justification of the closure of these bank accounts.